Researches have proven that more Kenyans survive on mobile phone loans because of the thrilling ways to get credit in Kenya. It is so simple to get immediate, safe loans via Loan Apps in the country. It is not only safer but now quicker as well, all thanks to the new world of Mobile Banking that gets everything done just with only a few taps.To make your selection process less complicated as you seek to get a loan via an app here is out List Of 20 Best Mobile Loan Apps In Kenya

1. Mshwari

This is a mobile banking service offered via M-Pesa partnering with the Commercial Bank of Africa (CBA). Mshwari has been existing since 7 years ago. The lowest loan you are allowed to borrow is Ksh 100 and no one knows the highest. To qualify for a higher loan limit, you will need to have repaid as at when due and also boost your saving amount in your Mshwari account. The repayment duration of one month is all you have plus an interest rate of 7.5%. The loan is processed in 5 minutes. To qualify for a Mobile Loan on Mshwari, become a Safaricom subscriber, have a registered and active Mpesa line used for half a year, an active Mshwari account and an updated Mpesa menu.

This is a mobile banking service offered via M-Pesa partnering with the Commercial Bank of Africa (CBA). Mshwari has been existing since 7 years ago. The lowest loan you are allowed to borrow is Ksh 100 and no one knows the highest. To qualify for a higher loan limit, you will need to have repaid as at when due and also boost your saving amount in your Mshwari account. The repayment duration of one month is all you have plus an interest rate of 7.5%. The loan is processed in 5 minutes. To qualify for a Mobile Loan on Mshwari, become a Safaricom subscriber, have a registered and active Mpesa line used for half a year, an active Mshwari account and an updated Mpesa menu.

2. KCB Mpesa

This is a partnership between the Kenya Commercial Bank (KCB) with Mpesa via Safaricom. It began to operate 4 years ago as a saving account and it has been active since that time. The lowest loan limit is Ksh 50 and the highest is Ksh 1,000,000. The cost of a months loan is 3.66% with excise duty applicable to payments. The condition to partake is you need to be an active registered Safaricom Mpesa customer for 6 months. Simply dial *844# and adhere to the instructions to activate our KCB-Mpesa account.

3. Tala (Formerly Mkopo Rahisi)

It was the first immediate mobile loan application launched as Mkopo Rahisi 5 years ago and later adopted a new brand, Tala. The Tala App needs you to possess a smartphone and a decent Mpesa Track record to enjoy their loans. The lowest loan you can get is Ksh 500 and the highest is Ksh 50,000 and at an interest rate of 15%. The loan has to be repaid every week in installments.

It was the first immediate mobile loan application launched as Mkopo Rahisi 5 years ago and later adopted a new brand, Tala. The Tala App needs you to possess a smartphone and a decent Mpesa Track record to enjoy their loans. The lowest loan you can get is Ksh 500 and the highest is Ksh 50,000 and at an interest rate of 15%. The loan has to be repaid every week in installments.

4. Branch

![]()

Branch International Inc is a company from San Fransico, with a branch in Nairobi, Kenya. It began four years ago and has been active since then. To qualify for it, you have to be a registered Mpesa user with a real and active Facebook account with usernames that match the ones on your National ID card. The lowest Loan limit is Ksh 1000 and the highest? nobody knows. The interest rate depends on the repayment of the weekly installments by the due date.

5. Saida

This is a mobile app to give you loans. To qualify for a Saida Loan, your Mpesa/Airtel Money accounts has to be active. The application reads and tracks your transaction and call activities to know if you are capable enough to pay back.

This is a mobile app to give you loans. To qualify for a Saida Loan, your Mpesa/Airtel Money accounts has to be active. The application reads and tracks your transaction and call activities to know if you are capable enough to pay back.

To access Saida, get the app from the Play store. Enter your mobile number and hold on for an invite to get loans, approval can take up to a week. The least loan you can get is Ksh 600, the highest is Ksh 25,000 and the interest rate is 10%.

6. OKOA Stima

Kenya Power, partnering with Safaricom began OKOA Stima 4 years ago and it is still active. It can help you settle your electricity bills. The lowest loan amount you can borrow is Ksh 100 and the highest is Ksh 2000 at an interest rate of 10%. The loan has to be repaid within one week.

7. Kopa Chapaa

This mobile app is facilitated by Faulu Kenya. You have to be an active airtel money for 6 months to be qualified for a loan. The lowest loan limit is Ksh 500 and the highest amount is Ksh 100,000. It as a really brief payment duration though as it is just a little over one week, 10 days to be precise.

This mobile app is facilitated by Faulu Kenya. You have to be an active airtel money for 6 months to be qualified for a loan. The lowest loan limit is Ksh 500 and the highest amount is Ksh 100,000. It as a really brief payment duration though as it is just a little over one week, 10 days to be precise.

8. Zidisha

This is an international firm which began in 2008 and has been active since then. This is a platform that lends money to people or business organizations through an online platform that brings creditors in contact with borrowers.

- Must Read: Best Places To Visit In Kenya As A Tourist

It is a non-profit organization which links borrowers from Kenya and across Africa, while the creditors are from North America and Europe. To qualify, you should be working or have a business, be of good character, a Facebook account, a brilliant online presence e.t.c.

9. Stawika

This is owned by Stawika Capital. The application checks mobile phone data plus other factors to assign loans. The app also makes use of information from CRB so ensure you are not listed on CRB before any application for a loan. An interest rate of 15% and loan is repayable via Mpesa.

10. Timiza App by Barclays

One of the recently launched loan apps in Kenya, it is a lovely loan tool from Barclays Kenya. The most amazing thing about Timiza is that it can be accessed by anyone with a smartphone. Also, you do not need a Barclays account to make use of this app. It is even a decent way to save, plus you boost your chances of getting a loan by depositing cash into the App via M-Pesa. If you do not have a smartphone, you are still not left out, because you can access loan services from Timiza by dialing *848# on your phone.

One of the recently launched loan apps in Kenya, it is a lovely loan tool from Barclays Kenya. The most amazing thing about Timiza is that it can be accessed by anyone with a smartphone. Also, you do not need a Barclays account to make use of this app. It is even a decent way to save, plus you boost your chances of getting a loan by depositing cash into the App via M-Pesa. If you do not have a smartphone, you are still not left out, because you can access loan services from Timiza by dialing *848# on your phone.

11. mKey

This represents the new era in financial services, solely focused on the consumers. It is brought to you by Finserve Africa and it is fast rising. With it, you access a keyboard with emojis. The app lets you send money to lots of mobile wallets including Mpesa, Equitel money, & Airtel money. Buying airtime for Safaricom, Equitel, Airtel, Telkom or Faiba is also possible. Payment of bills can be done on it too.

12. HF Whizz App

This app is brought to you by HF Group. It is unique and lets you borrow at least 50,000. Asides loans, you are also allowed to pay bills and transfer money to others. Just download via the Google Play Store and the registration process is very uncomplicated. You receive your loans easily here.

13. Haraka

This app provides you with the fastest and most comfortable way to get a loan in Kenya. It allows everyone to access credit wherever and whenever in Kenya. Applying for the loan is easy. No paperwork is needed and your loan gets to you as quickly as possible.

Before you can apply, you will have to register with their Facebook account. An M-PESA account is also required because this is where loans will be sent to. You will have to repay within one week to one month.

14. Utunzi

This application allows you to access safe, personal loans in Kenya through your mobile phone. Finance can be gotten at any time and anywhere in Kenya using Utunzi. It is fast and simple to use and you will not have to wait a very long time for your loan to be approved.

15. Chapeo Capital

This app offers short-term credit solutions, payroll processing functionalities, worker advances, and bill payments options, which can all be taken advantage of via your mobile phone. The interests you will have to pay when you receive a loan is nothing much. It is very useful for the days you will need some quick cash. Anyone who gets a loan from Chapeo Capital is actually doing business with a company that knows what making loans available from an app is all about.

16. Jazika Loans

This is another mobile loan app from Jazika Ventures. With this app, you will be qualified for the highest amount of 100,000 Kenyan shillings and the application process is easy enough. The money goes straight into your M-Pesa and repayment is also via M-Pesa.

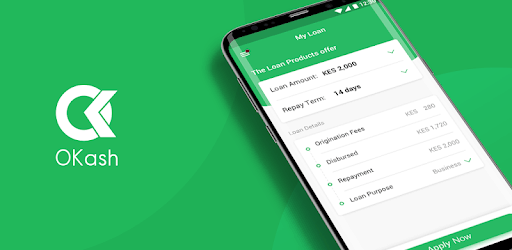

17. Okash

This is one of the most comfortable apps that provide loans in Kenya. Creation of an account is also very fast. You only require your Mpesa number, that you will type in as you open the app. You will now receive a verification code via SMS to your number just for proof that you truly own the Mpesa account. You can now create a profile by sharing information about yourself. If you are between 20-55 years of age, you can access this mobile application.

This is one of the most comfortable apps that provide loans in Kenya. Creation of an account is also very fast. You only require your Mpesa number, that you will type in as you open the app. You will now receive a verification code via SMS to your number just for proof that you truly own the Mpesa account. You can now create a profile by sharing information about yourself. If you are between 20-55 years of age, you can access this mobile application.

18. PesaZone

This app lets you borrow between Kshs 250 – 15,000. It monitors if you are eligible and whether you meet their credit rating. If you do, you will need to pay a little verification fee, snd your loan gets to you within 24 hours through your Mpesa account. If you fail to do the needful before repayment expires, there are consequences.

19. Okolea

This is a loan app with a very low-interest-rate in Kenya. At 0.6% daily, you can borrow cash without being pressurized to pay back with massive interest, when it is time for repayment. When registering, you will be asked to pay the vital fee of Kshs 100. Here is a cool catch, every single time you pay back before repayment date, your loan limit is increased by 20%.

20. Equitel

The loans here only concern Equity bank account holders. To access it, you must own an equitel line which is connected to your bank account. After that, access is seamless. Just head to equitel toolkit and choose the kind of loan you desire. Then, enter the amount you want and submit the request. Equitel is really comfortable to use since it lets you check your loan balance and make repayments directly from your smartphone, without needing any physical presence at the bank.

There you have it – Best Mobile Loan Apps in Kenya. If you have other recommendations, feel free to drop them in the comment section below.