When it comes to making purchases from e-commerce websites, especially in these parts of the world, we are most times limited to using our credit cards. In recent times, there has been a massive adoption of cryptocurrencies to make purchases from local websites. But one problem a lot of people in Nigeria tend to face is having to use the medium while merchants find it difficult to convert these currencies into the Fiats for their banks.

This has been a problem for merchants here in Nigeria and that’s where Coinqvest comes to the rescue offering merchants the capability to receive payments in the form of digital assets and get the amounts converted and sent directly into their Nigerian bank accounts.

What is Coinqvest?

According to the official website, here’s what coinqvest is all about:

“COINQVEST provides digital currency checkouts that automatically go from Bitcoin to a bank account, in minutes. COINQVEST helps online merchants and e-commerce shops programmatically accept and settle payments in new digital currencies while staying compliant, keeping their accountants and tax authorities happy. With COINQVEST, online businesses can denominate and settle sales in a national currency (e.g. EUR, USD or NGN) regardless of whether their customers pay in Bitcoin, Ethereum or Stellar Lumens.”

Simply put, this platform provides merchants and e-commerce stores a means to accept all sorts of cryptocurrencies, while the store gets paid in the local currency directly to their bank account upon a withdrawal request.

We did give this a shot and had it working for us in no time.

How to Integrate Coinqvest on Your Website

Integrating Coinqvest to receive payment is quite easy and can be done programmatically for developers or otherwise using the web interface for non-developers. Below are detailed paragraphs to get you started.

Integrating Coinqvest as a non Developer

Receiving payment as a non-developer using the Coinqvest platform is quite straight forward and simple. It involves 4 steps, viz:

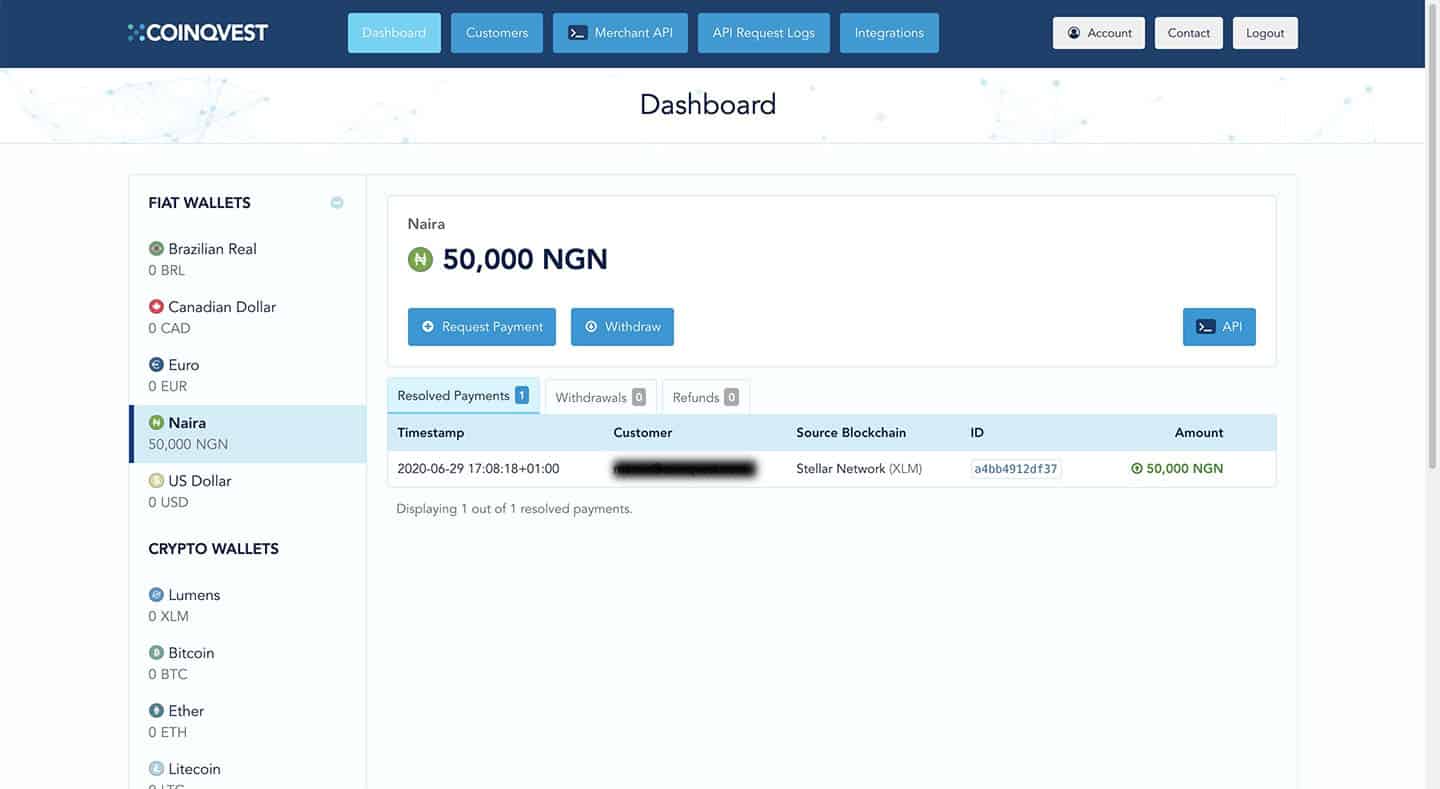

Step 1: Login to your Coinqvest dashboard and click on the request payment button as seen in the photo below.

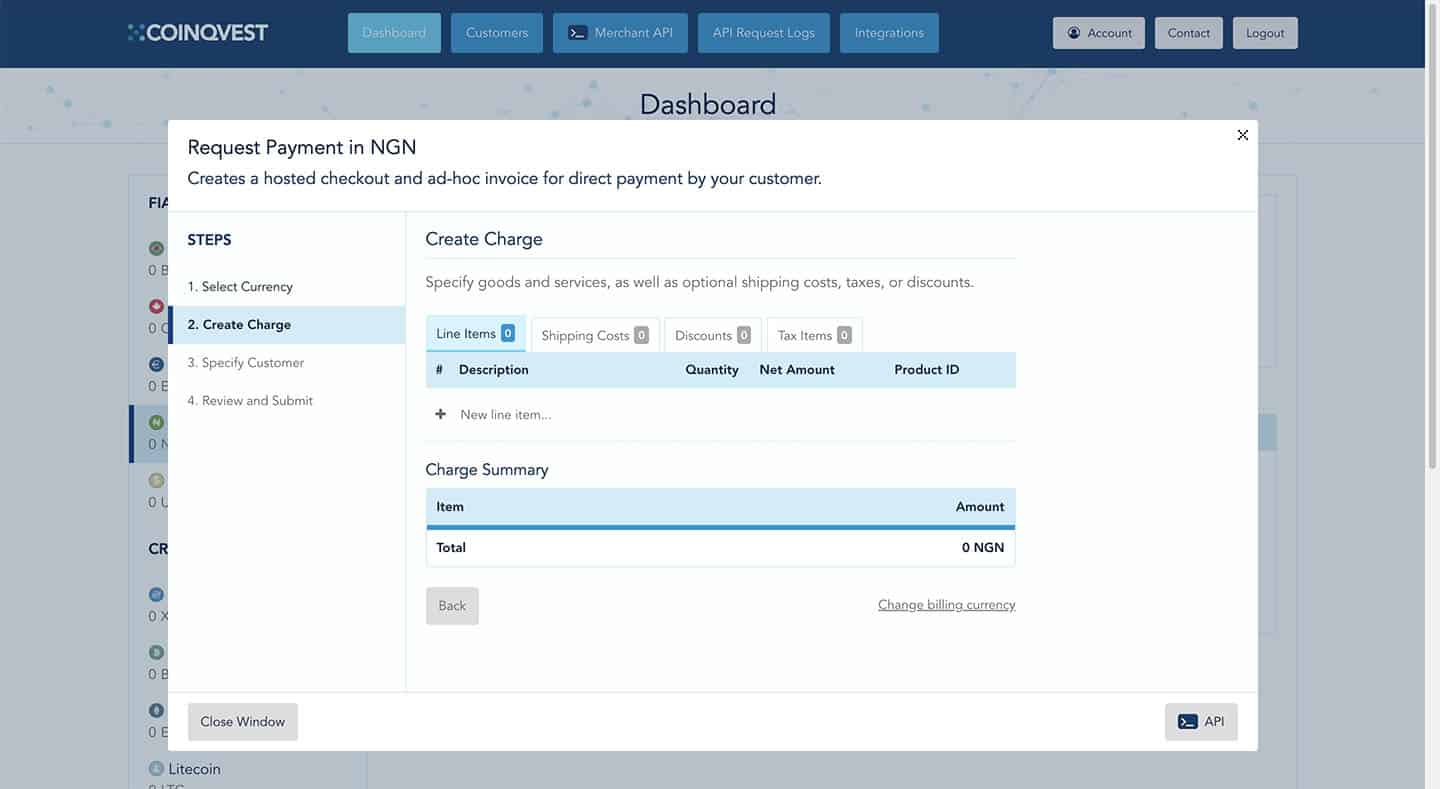

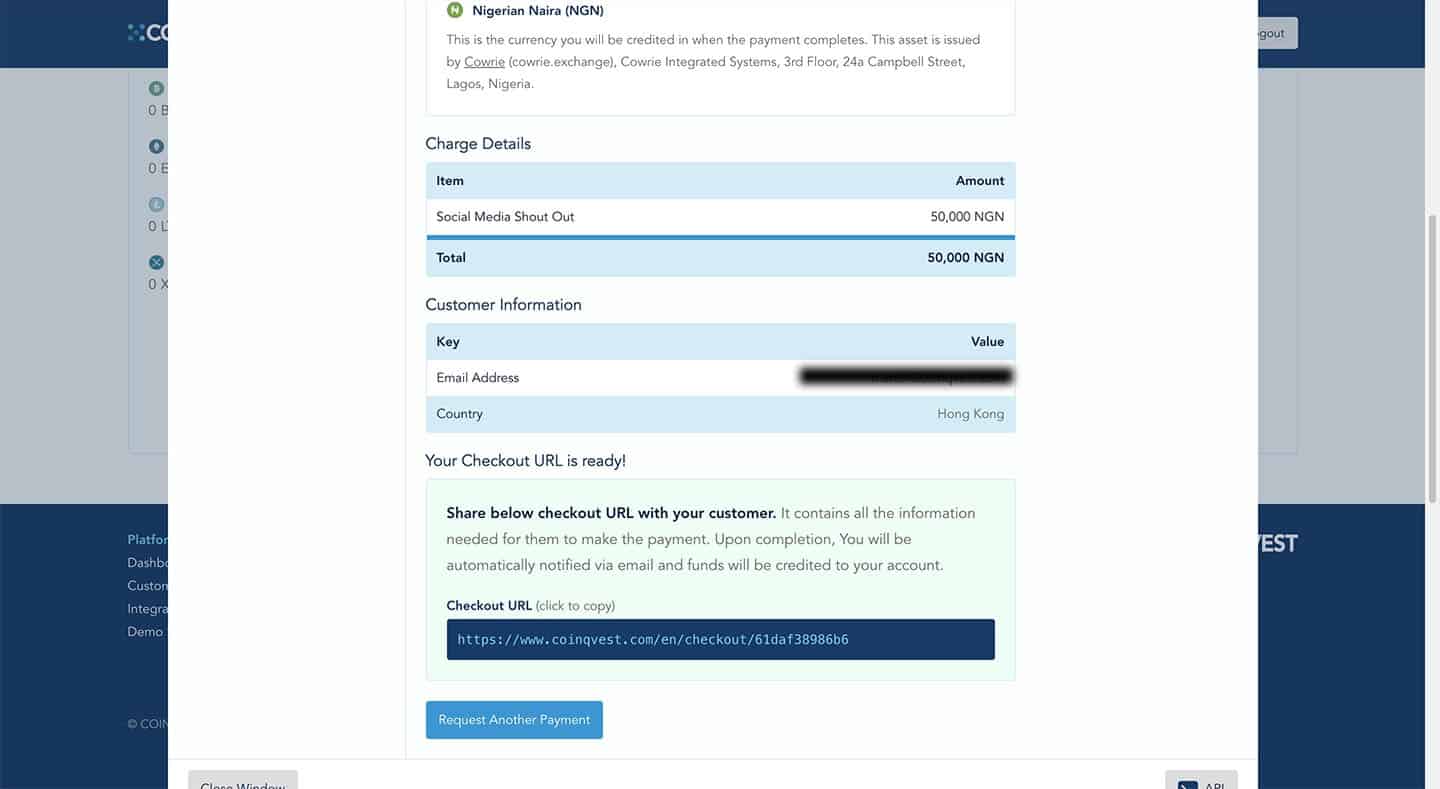

You should get an overlay where you have to enter the details for the payment request you are to place.

Click on Next to get to the next step.

Step 2: You then have to create a charge, enter the details for the transaction and amount. Clicking the “Change Billing Currency” link on the bottom right lets you change both your billing and settlement currencies.

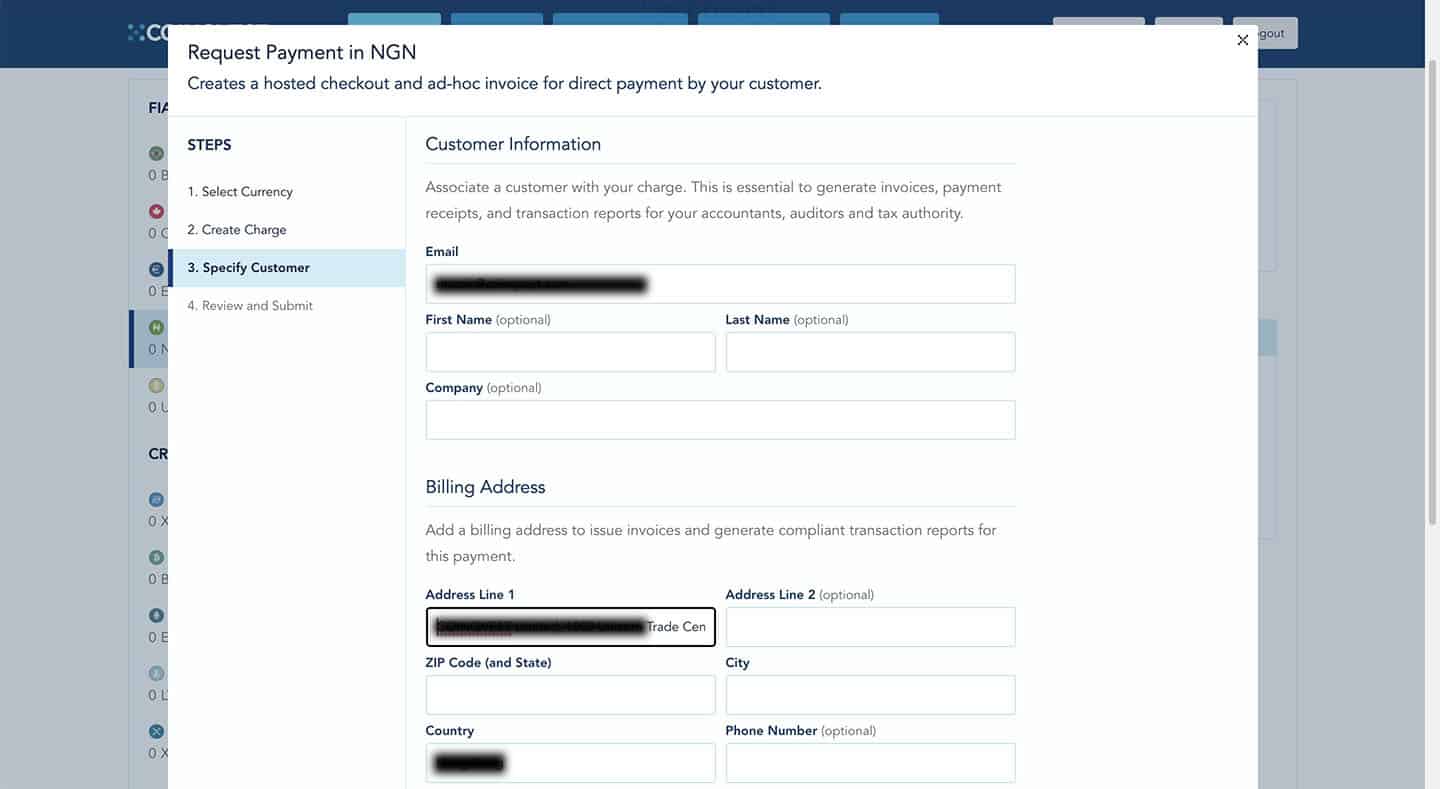

Step 3: Enter the customer details and email in this next step.

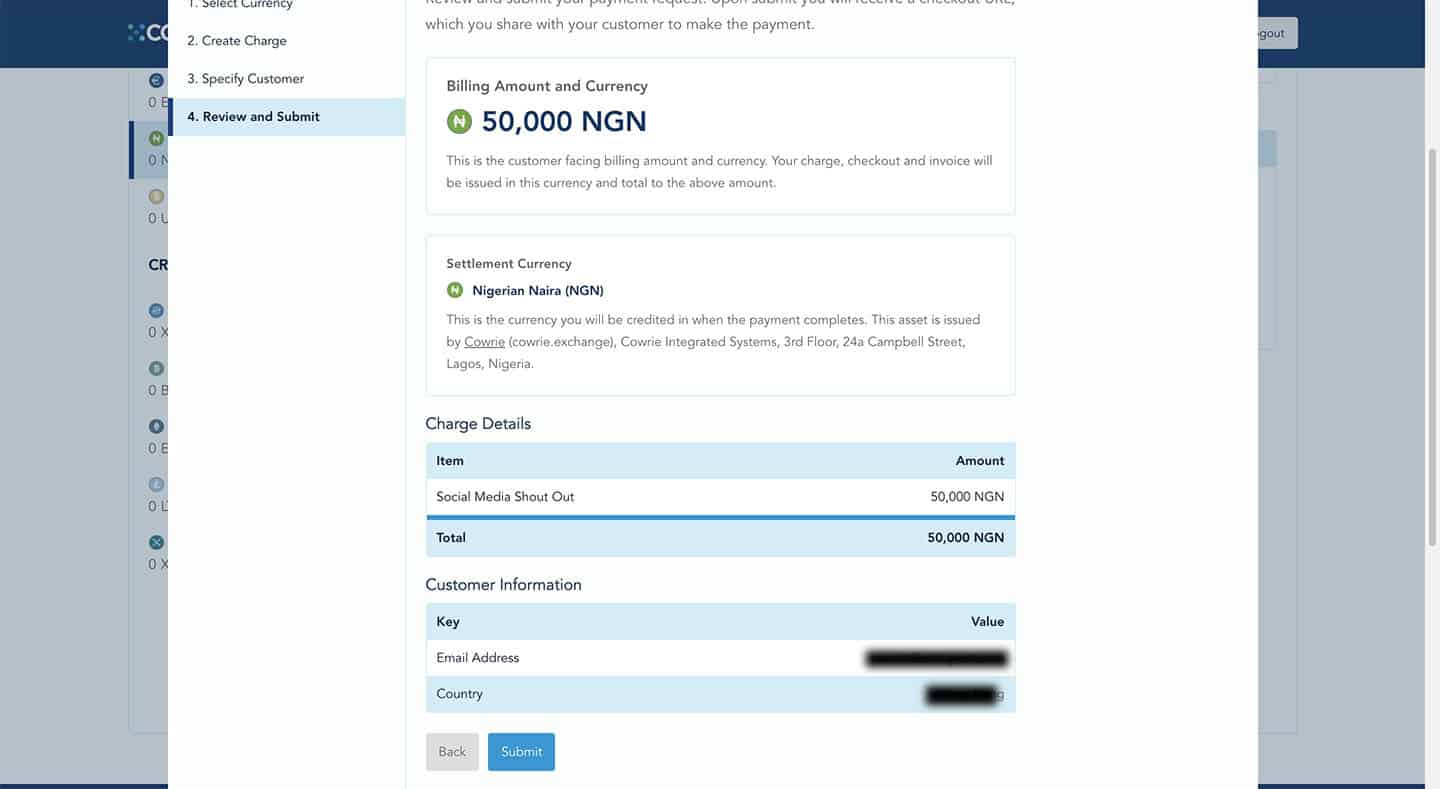

Step 4: Review the payment request and submit.

You should be able to see the invoice URL (address to the payment) which you can send over to the client to make their payment.

Upon visiting the page, the client would get options to make the payment spanning through a couple cryptocurrencies, and you’d be rest assured that despite their pick, you still get your equivalent paid to your account in Naira.

How to Integrate Coinqvest for Developers

Integrating Coinqvest on your platform is a little different if you are a developer trying to incorporate this option into your payment platform alongside options like Flutterwave, Paystack or PayPal.

First off, if you use a Content Management System such as WordPress, Coinqvest already has a plugin on the WP repository readily made to get you going with this.

Otherwise, you are provided with an API and also an SDK as a merchant who wants incorporate things themselves. Visit the API Settings to obtain your API-Key and API-Secret which would be used for authentication in the SDK you download.

For instance, if your platform is PHP based, you can get the SDK on GitHub, and you must have at least PHP 5.3 running, curl extension for PHP and OpenSSL extension for PHP also. The SDK can be integrated as a Helper Class in Laravel for instance and called in whatever Controller that handles the payment on the platform. You can refer to the Documentation page to get more details on the API as this article isn’t a tutorial for such.

How to Request a Withdrawal to Bank Account on Coinqvest

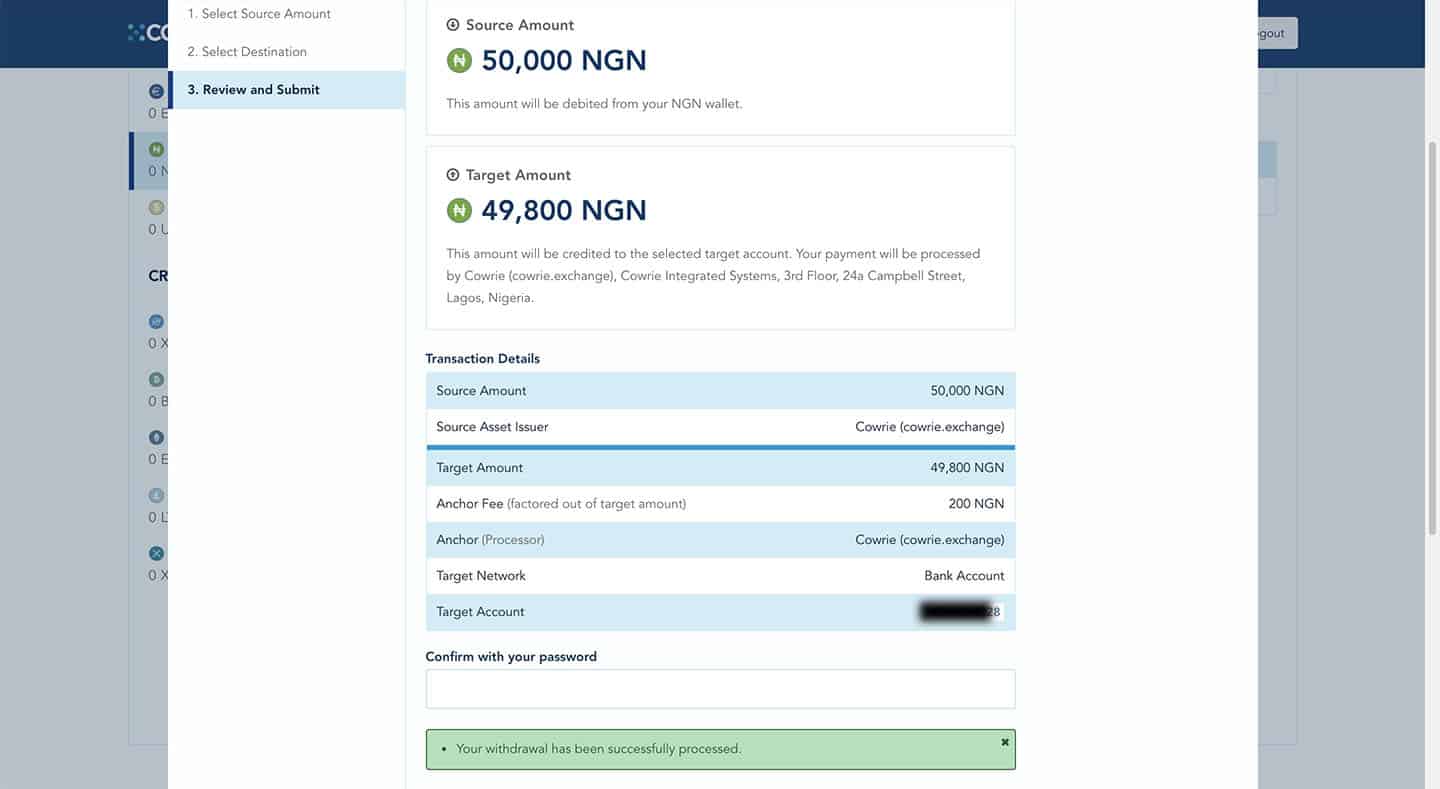

Say you’ve gotten an approved payment and you need to make a withdrawal to your Nigerian account, it basically took less than a minute after I clicked on Withdraw and I received a Credit Alert from my bank.

First off, before you are able to place a withdrawal, you need to verify your business by providing the business registration and a valid means of identification. I’m assuming you have done those in the setting before you want to withdraw. More so, it took 30 minutes after submission of my documents and the account was verified for withdrawal. Let’s get back to the process of withdrawal.

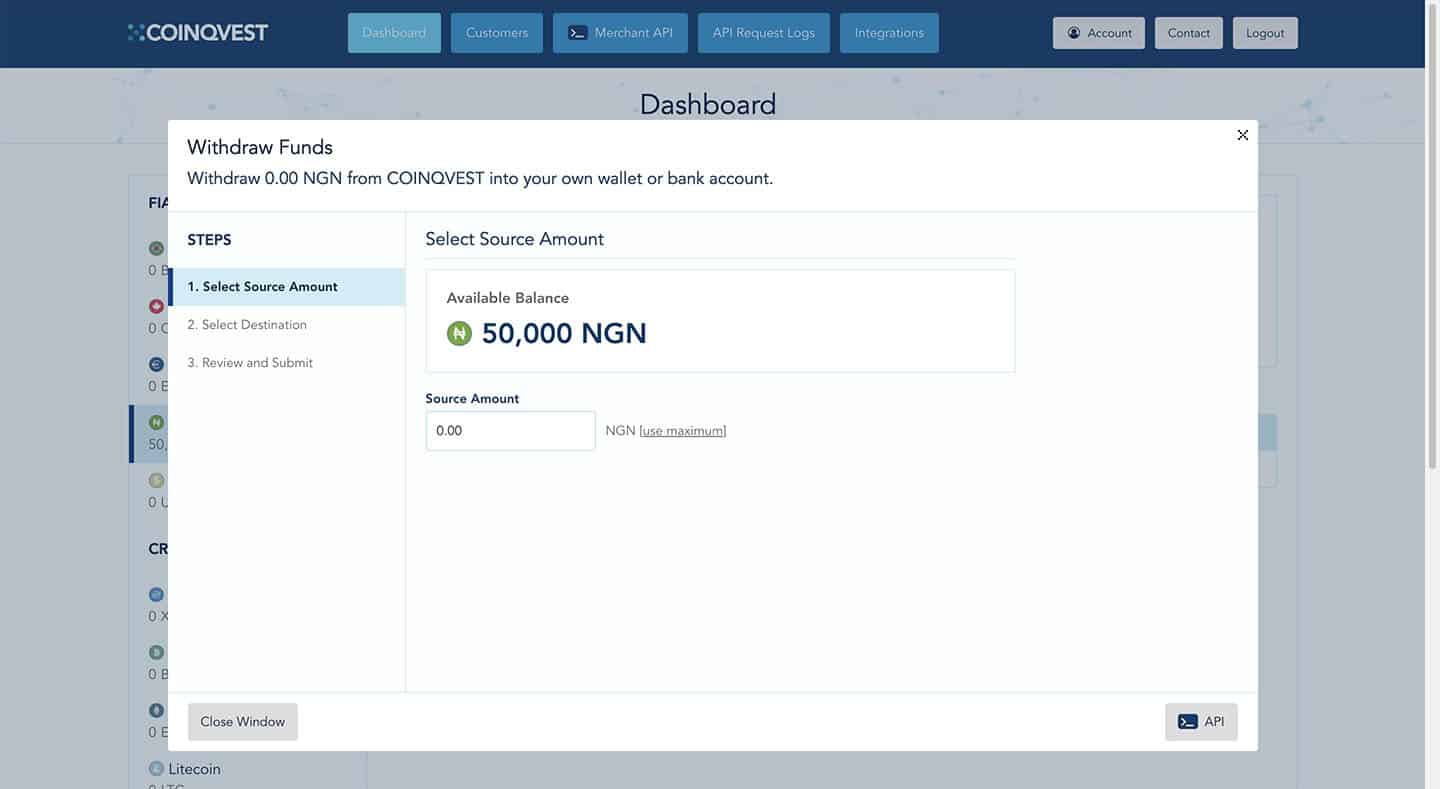

- Click on the Withdraw button after clicking on the currency side link (in this case Naira) as shown below.

- Enter the amount you wish to withdraw and click on Next

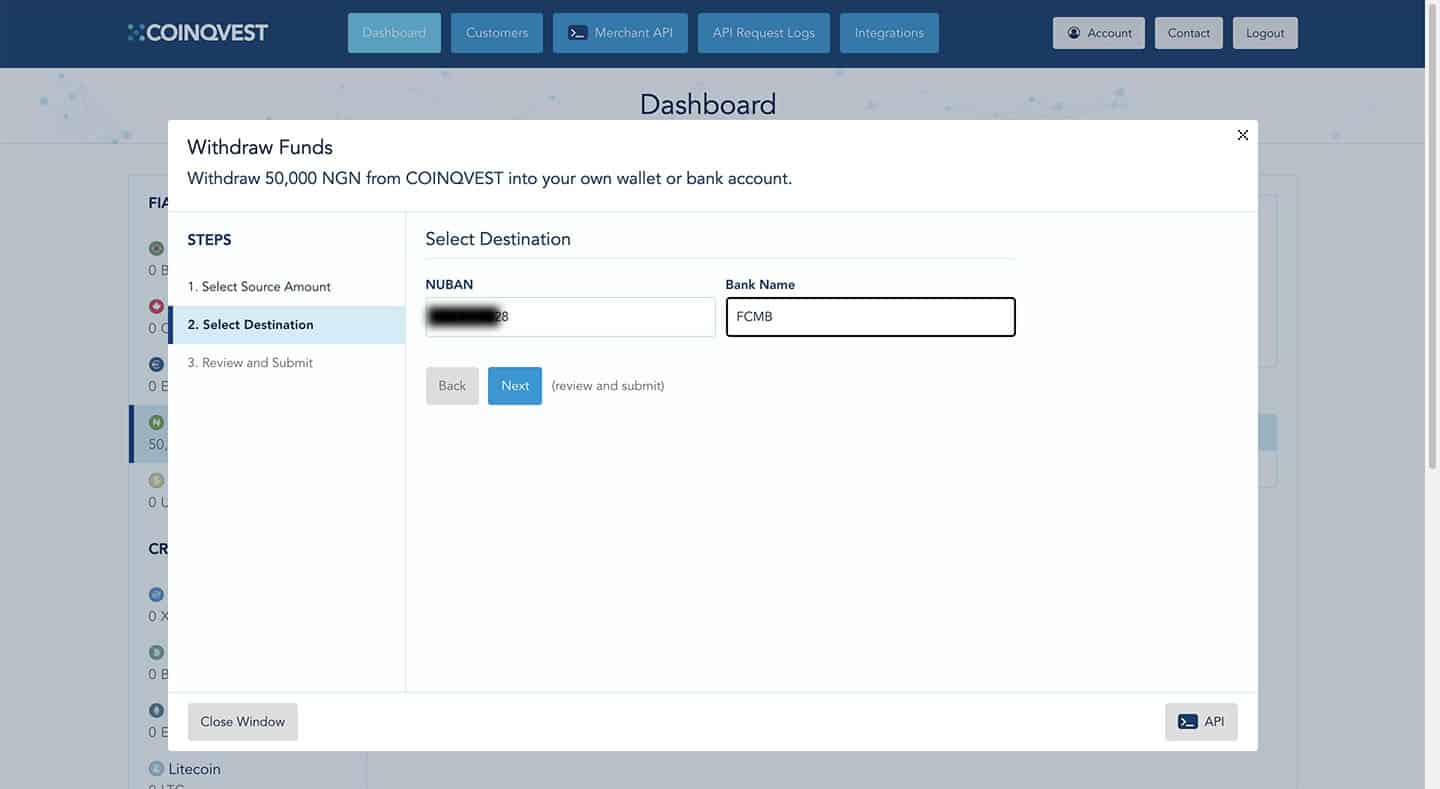

- In this next step, you need to select your destination/method of withdrawal which could be cryptocurrency or Bank Account. After you select Bank Account and select the currency.

- The next step requires you to input your bank details to proceed.

- You hit on Submit and wait for a review, it should take less than a minute and you’d get your bank account credited with the amount placed for withdrawal (I was charged N200 for a N50,000 withdrawal).

Some FAQs for Coinqvest

Question: Is Coinqvest only meant for businesses/merchants?

Ans: No, you can create individual/personal accounts.

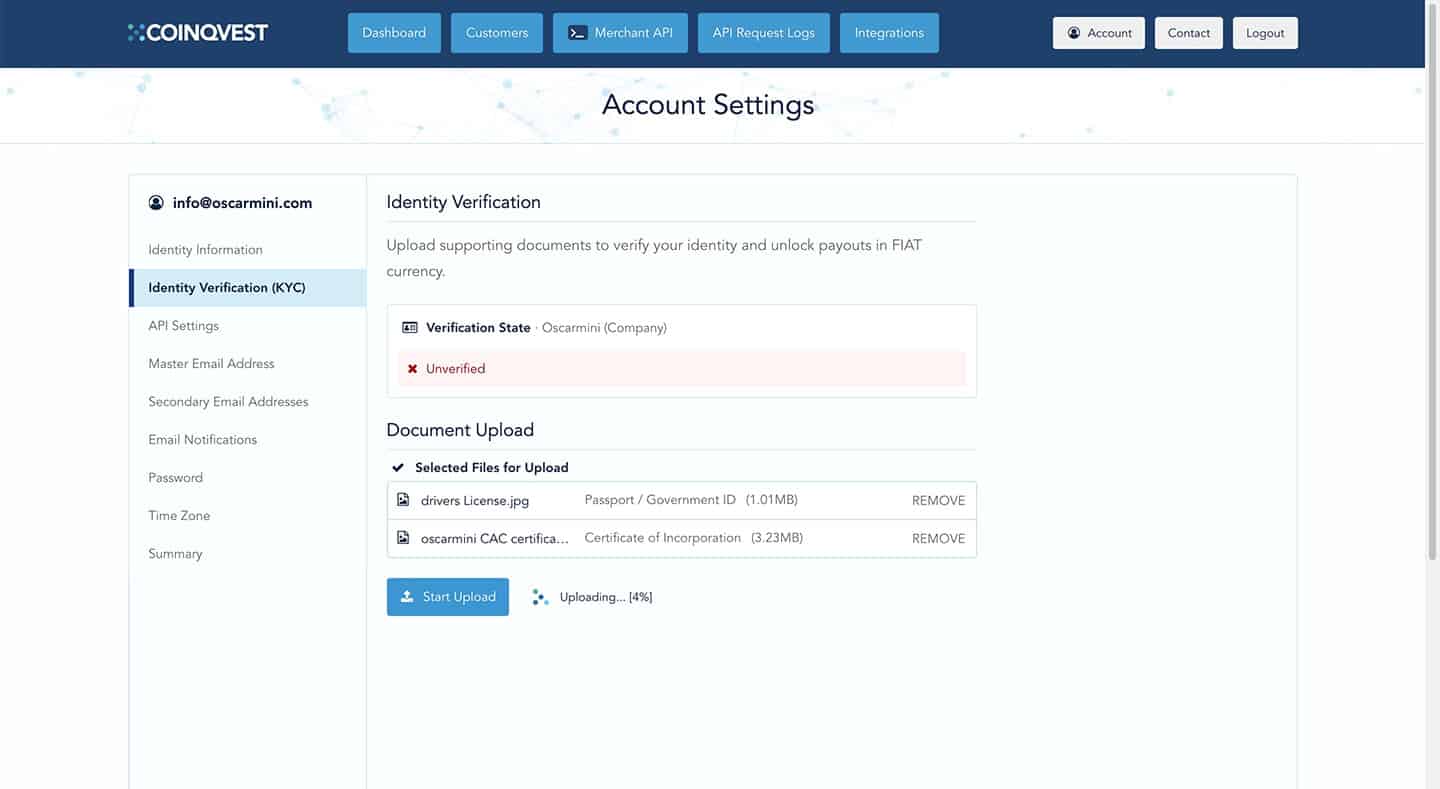

Question: What are the requirements for Identity Verification?

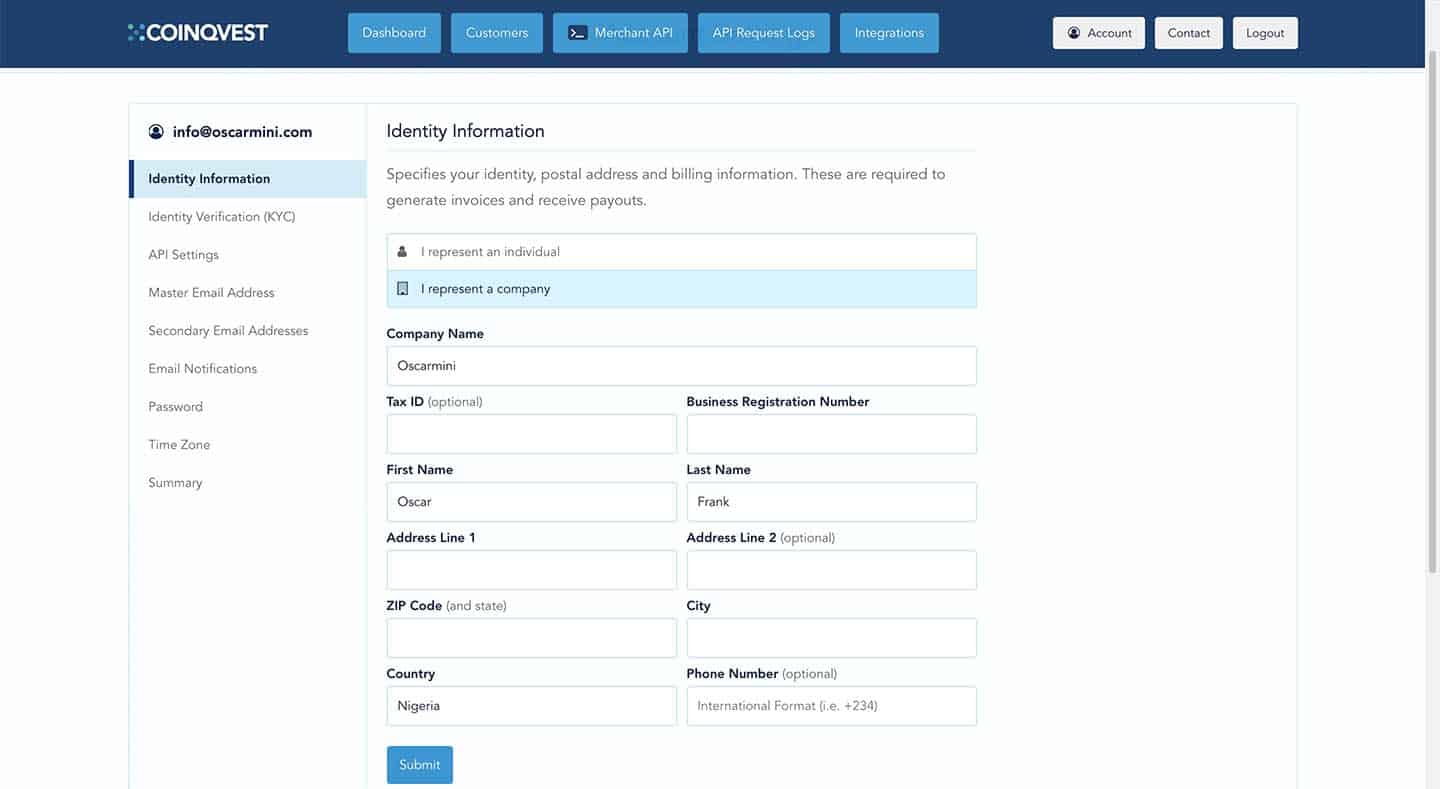

Ans: If you are a business owner, you need to upload your business certification and your personal government identification as shown below. It takes less than 1hour for its verification.

Question: What are the requirements before placing a withdrawal on Coinqvest?

Ans: You need to complete your Identity verification as seen above and also complete your Identity Information as seen below.

Conclusion

So, in terms of receiving payments (especially cryptocurrencies) on your e-commerce website in Nigeria, with the aim of withdrawing to your bank accounts, Coinqvest has proffered a solution that definitely meets this need and expands the reach of Nigerian merchants. One notable merchant would be Payporte who have recently incorporated this on their platform.

Do let us know your thoughts on Coinqvest in the comments we’d love to hear from you.