On Monday, October 25, 2021, Nigerian President Mohammadu Buhari unveiled the Nigerian form of Central Bank Digital Currency called the eNaira. The CBN launched the project called “project giant” to produce and issue a government-controlled digital currency on June 24, 2021.

What is the e-Naira?

The eNaira is the digital form of the Nigerian currency “Naira”. It is the digital naira issued by the Central Bank of Nigeria and it has the same exchange value as the fiat naira.

Cryptocurrency vs. eNaira

The eNaira is a Central Bank Digital Currency. CBDCs are digital forms of central bank money that are different from balances in the traditional reserve or settlement accounts. CBDCs are also known as digital payment instruments, denominated in the national unit of account, and are the direct liability of a central bank of a country.

CBDCs are digital forms of physical legal tenders and have the backing of a centralized institution which is the central banks of different countries. This is the major difference between CBDCs like the eNaira and Cryptocurrencies like Bitcoin.

Cryptos function on blockchain technology and completely focus on the decentralization of creation. Cryptos are not regulated and they are distributed through the use of decentralized computer networks.

Must Read: Basic Intro To The Technology Behind CryptoCurrencies [For Amateurs]

Cryptocurrencies maintain anonymity in transactions because they are secured by cryptography which makes it hard for third parties to obtain information while the issuing entity of CBDCs can access information provided by users.

Why The e-Naira?

According to the CBN IT department director, Rakiya Mohammed, the CBN started the research of digital currency in 2017. CBN had specified that the plan for eNaira is to use it to further cross-border trade facilitation, financial inclusion, monetary policy effectiveness, improved payment efficiency, and revenue tax collection.

Must Read: How to Buy Cryptocurrency in Nigeria and the Benefits of Using Digital Currency

CBN believes that the eNaira will help further financial technologies with their operational efficiency. e-Naira was not created to replace the traditional payments system but to assist it. With the launch of the eNaira on October 25th, Nigeria became the first African country to launch its own CBDC.

How the e-Naira works:

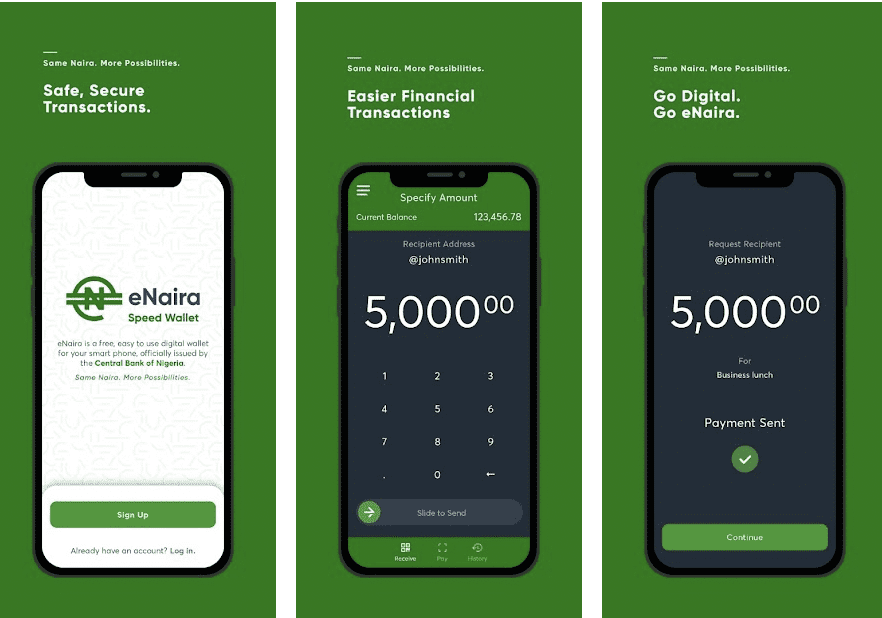

To use the eNaira, it is necessary to create eNaira wallets “speed wallets”. The wallet is digital storage managed through blockchain technology and holds the eNaira.

The CBN will supply the eNaira from their stock wallet to intermediaries who will then supply to individuals. The intermediaries, financial institutions, will oversee ID verifications, payments processing, and maintaining the wallets. The CBN provided different tiers of wallets as shown below:

| Types of wallet | Cumulative balance Limit | Transfer Limit | KYC Requirement |

| Tier 1 | 300,000 | 50,000 | No existing bank account, phone number validated by NIN |

| Tier 2 | 500,000 | 200,000 | Existing Bank account and Bank Verification Number (BVN) |

| Tier 3 | 5,000,000 | 1,000,000 | Existing Bank account and BVN |

| Merchant | No limit | 1,000,000 | Full KYC requirement and Anti-money laundering and counterfeit terrorism regulation of the CBN |

To create an eNaira wallet, smartphone users will have to download the e-Naira app and complete the registration process. Once the wallet is created, users can transfer money from bank accounts and credit cards and perform other monetary transactions.

Potential Benefits of the e-Naira

eNaira could eliminate the technicalities in using intermediaries such as banks and clearinghouses. This will create ease in making money transfers and payments. Goods and services could be paid in time with fast verifications and reduced waiting queues formed as a result of slow transactions. This reduces complexities in payments processing.

Must Read: Benefits of Crypto Currency and How to Start Using It

The use of eNaira could also eliminate transaction fees or lower these fees. CBN has stated that there will be no charges for peer-to-peer transactions and payments to merchants.

e-Naira is expected to increase financial inclusion by offering more Nigerians will have access to digital currency.

If properly managed and regulated, the eNaira could make tax collections easier and tax avoidance and evasion much more difficult. Close monitoring could also make it easier to spot fraudulent transactions and track financial crimes.