German Grocery delivery startup Flink said on Friday it had raised $240 million from investors, just six months after the Berlin-based company was founded, and struck a strategic partnership with the Rewe Group supermarket chain.

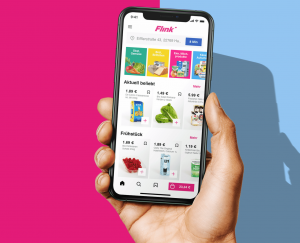

Flink is one of a crop of firms including Gorillas, Getir, and Weezy that have grown explosively during the COVID-19 pandemic with their promise to deliver groceries within minutes of an order being placed via a smartphone app.

Its Series A funding round was led by Dutch-based consumer internet investor Prosus, San Francisco technology investor BOND, and Mubadala Capital, which is part of Abu Dhabi’s sovereign wealth fund.

Flink said it has set up more than 50 local hubs in its first four months of operation, and is opening a new hub every two days and can already reach more than three million customers directly.

Must Read: Almentor raises $6.5M in Series B funding

“The order growth we have seen over the past weeks has been explosive and we attribute that to the excellent service we are providing to our consumers,” said founder Oliver Merkel.

With global player Delivery Hero announcing a return to its German home market, attention is being focused on whether establishing a standalone operation or partnering with supermarkets will be the better strategy.

Flink’s capital raise rounds off a record week for investing in German startups, with software company Celonis raising $1 billion, and online insurer Wefox and transport app Flixbus both pulling in $650 million. (Reporting by Douglas Busvine, Editing by Sherry Jacob-Phillips).

Must Read: Samurai Incubate closes “Samurai Africa Second General Partnership” Funding Round To Tune of 18M

Officially launched just six weeks ago, Flink, which means “quick” in German, claims to deliver groceries from its own network of fulfilment centres in less than 10 minutes.

That puts it up against dark-store competitors including Berlin’s much-hyped Gorillas and London’s Dija and Weezy, and France’s Cajoo, all of which also claim to focus on fresh food and groceries.

There’s also the likes of Zapp, which is still in stealth and more focused on a potentially higher-margin convenience store offering similar to U.S. unicorn goPuff.