A Nigerian fintech company, NowNow Digital Systems, has raised $13 million in a seed round to increase financial inclusion throughout Africa by offering financial services to the continent’s unbanked and underbanked population. According to the company, the funding will enable it to launch new products that will further improve its current consumer banking, agency banking, and merchant payment solutions.

NeoVision Ventures Ltd., DLF Family Office, and Shadi Abdulhadi led the round of funding. According to the founders, these investors understood NowNow’s business model, the African market, and what it takes to sustain growth in a challenging market. The fintech platform was also recently chosen to participate in the Mastercard Start Path Global program, which was created to assist later-stage startups in innovating and scaling.

Must Read: Moove, a Nigerian Mobility Fintech Startup Raises N12bn

The funds will be used to develop more digital financial inclusion solutions and to expand its services across Africa, including Angola, where financial literacy is only 15%, Liberia, and Equatorial Guinea.

The company has also teamed up with the Sustainable Inclusive Digital Financial Services (SIDFS), a research and advocacy program run by the Lagos Business School, to launch a financial education and literacy program that aims to advance financial inclusion in Nigeria. NowNow wants to make use of SIDFS’s extensive data, library materials, and resources to offer its customers financial and digital literacy tools that will enable wise financial planning.

Must Read: Kippa Raises $8.4 Million Seed Round

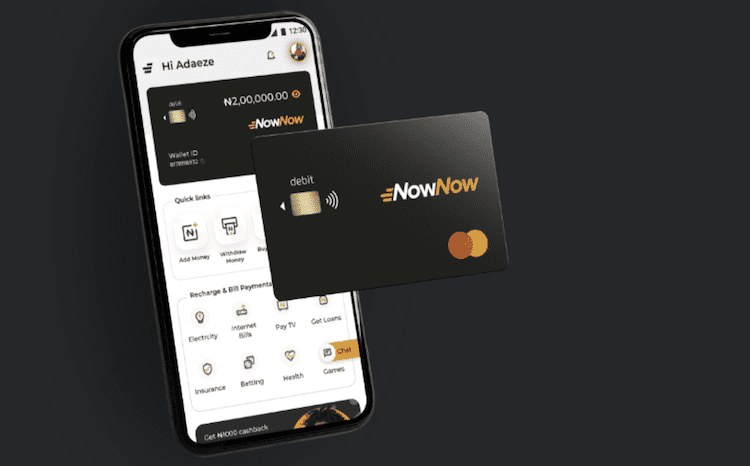

NowNow distinguishes itself from competitors such as Kuda and TeamApt by having a proprietary infrastructure on their open API network/and an open API network that other financial institutions use to provide access to different markets both locally and internationally, according to the founders, Sahir Berry and Mahesh Nair.

The founders claim that NowNow operates in both the B2C and B2B sectors, providing agency banking to consumers and small businesses as well as its platform-as-a-service to businesses. The business asserts that it has more than 50,000 agents in Nigeria who assist clients with money transfers, bill payments, and airtime purchases. Additionally, customers can use the company’s app to access services like insurance, loans, and a wallet on their own.